You want to start a business. Now what?

You’ve done your research and you’re ready to hit the throttle. Then you realise you haven’t got the first clue where to start when it comes to setting up a new business.

Here’s the rundown on everything you need to know about choosing a business structure and setting up your business.

Learn the Lingo – Business Terminology

First thing’s first, you need to familiarise yourself with some common business terms and acronyms, otherwise, the rest of this article isn’t going to make one bit of sense.

If you’re not already up to speed with ACNs, ABNs, TFNs and the many others that you’re going to come across, you might benefit from a business lingo refresher here.

Get Licensed

Depending on your industry, you may need to apply for a license (or more than one) to operate your business. For example, financial planners and credit providers (such as mortgage brokers), will need to look into Australian Financial Services (AFS) licenses and Australian Credit licenses (ACL).

In the construction industry, the license you need will depend on the type of work (for example, landscaping vs civil construction) you’re doing and where you’re located. And with food businesses, again, you’ll need to check out the requirements in your state.

If you’re thinking about expanding your business, make sure you keep on top of your licensing. For example, as you grow you might change your business structure from a sole trader to a company, in which case you might need to cancel the individual license and apply for a company license.

If you expand into a new territory (say you open a new location for your NSW business in QLD), you’ll need to make sure you’re meeting the licensing requirements in both states. And finally, if you change or expand your team, you’ll need to have a process in place to make sure your team members come on board with the correct licenses and maintain them.

The repercussions for failure to maintain licenses can vary from stop work orders to fines and penalties – nothing good!

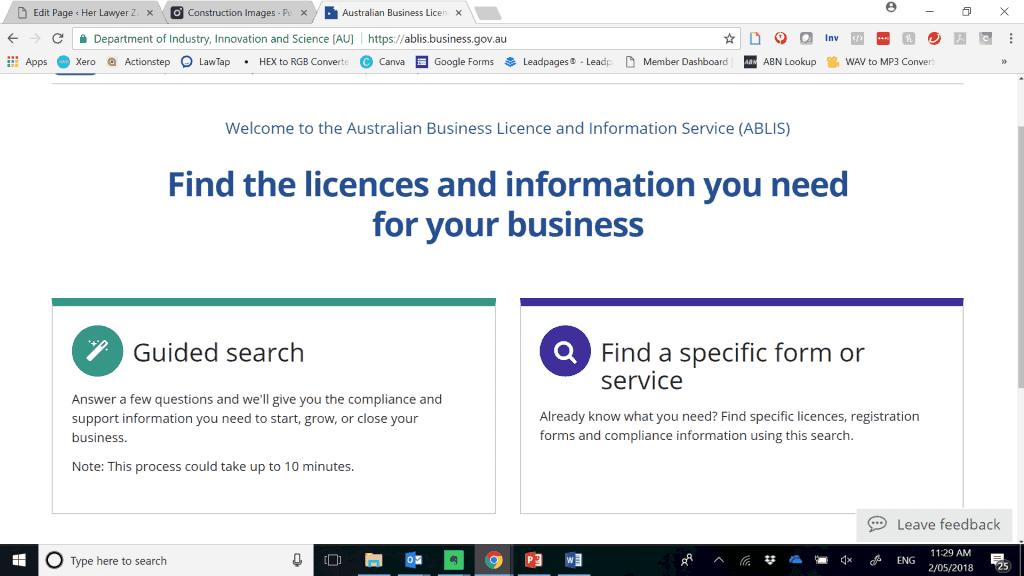

The best place to find out (for free – bonus!) what licenses you need is the Australian Business Licence and Information Service, or ABLIS. Use their easy search function to find relevant information for your business on licenses, registrations, permits and assistance you need, across all levels of government. Think of this as your business Bible.

Check you’re not infringing anyone’s IP

Once you’ve got your name and tagline, do yourself a favour and check IP Australia’s trademark register for your chosen name. Do this before you start using it, as you might be unknowingly infringing someone else’s trademark in which case you can expect a nasty cease and desist letter in the mail, which may or may not be accompanied by a request for $. “So what?” I hear you say.

Well, worst case scenario you’re looking at things like damages (cash to compensate them for the loss they’ve suffered due to your action), injunctions (to stop you using the mark or tagline) or even an account of profits (you pay them money you’ve made off the mark) – ouch!

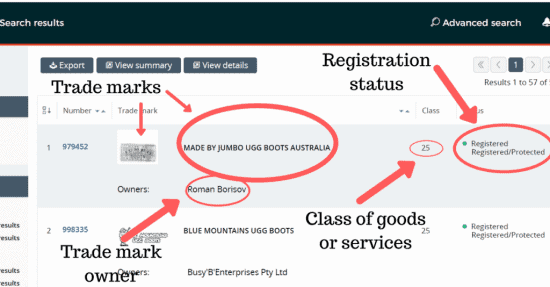

Enter your search term (if it’s a logo, describe what it looks like). If you get some results, check out what the trademark looks like or says. See if the class of goods or services it’s protected in is the same as the class your business will be operating in. If so, in most cases it’ll be back to the drawing board.

If you’re absolutely tied to the name, think about talking to an intellectual property specialist about other options that may be available, which may or may not include getting in touch with the trademark owner to see if it’s possible to get a waiver or sub-license.

Once you’ve cleared the trademarks issue, check the business name register to make sure the name is available.

Get your business structure right

Choosing the right structure for your business is an important step in your startup journey. The consequences of using the wrong structure can be disastrous. On the other hand, if you pick the right structure, you can enjoy benefits including paying less tax, protecting your personal assets and making your business more attractive to investors.

Don’t know your sole trader from your trust? No worries, here’s a summary of the most popular options:

The easiest and least expensive way to structure your business. Just register your business name (or use your personal name to skip this step), apply for an ABN and register for GST when your annual income grows to $75,000. Major ups: cost and control. Major downers: unlimited liability. Good for: hobbyists or side businesses. Reconsider if: significant income, assets or debts are involved.

Ownership and control are shared by 2 or more people. Relatively inexpensive to establish and the only ongoing cost is that of the annual partnership tax return. Major ups: flexibility and tax. Major downs: joint and several liabilities. Good for: side business with a few trusted partners. Reconsider if: larger number or unknown partners, significant income, assets or debts are involved.

One of the most popular structures for business owners in Australia. Major ups: capped tax and limited liability. Major downs: set up costs, extra responsibility and admin. Good for: most businesses. Reconsider if: you lack someone on your team with great attention to detail and time management.

Listed on the Australian Stock Exchange, with private investors invited to purchase shares. Major ups: access to capital and limited liability. Major downs: cost and regulation. Good for: well-established businesses looking to scale. Reconsider if: you’re still early stage or have other easier options to access capital.

A mix of structures often called a corporate group. The structure will depend on the circumstances of the business and professional advice will be needed to get it right. Major ups: structure customised to suit the exact needs of the organisation and individuals behind it, tax savings, asset protection and so on. Major downs: cost and time to set up and administration. Good for: tech startups, companies with multiple arms or operations. Reconsider if: you’ve got a simple structure and no intention of growing out of it, or if you’ve got no budget for setting up and maintenance costs.

Get an ABN and TFN

Once you’ve set up your structure, you’ll need to apply for an Australian Business Number (ABN) for the business. If you’re operating other than as a sole trader, this will be different from your personal ABN (if you have one). (PS – if you upgrade from a sole trader to a different structure and no longer operate a business in your personal capacity, don’t forget to cancel your personal ABN!)

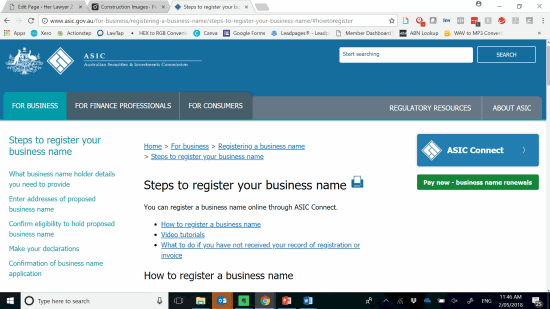

Once you’ve got your ABN, you can apply to register your business name online.

You’ll also need to apply for a Tax File Number (TFN) if you’re in a partnership, operating a company or trust. This is separate from your personal TFN and means you’ll need to file a separate tax return for the business entity.

Many entrepreneurs can’t afford an accountant straight out of the gate, and if that’s the case it’s worthwhile spending some time to familiarise yourself with your tax obligations, to make sure you don’t end up handing a shoebox full of faded receipts to a busy accountant at the last minute come tax time.

The ATO runs free seminars and has an excellent video series on tax basics for small business available online. There are also fast, affordable and intuitive software solutions available for business finances – think about signing up to help you manage your budget, track your tax and study the numbers month to month (hint: cash flow management is key!)

Get a business bank account

If you’re operating other than as a sole trader, you’ll need to keep your personal and business funds separate, so you’ll want to set up a business bank account (it’s much easier if you keep them separate anyway, even if you are a sole trader). Many lenders offer specialist business accounts (though sometimes any old account will do).

The bank will need to see a copy of the certificate of incorporation for a company or trust deed for a trust, and you may need to visit a branch to provide proof of your identity if you’re not already a customer of the bank.

Get your documents in order

Set out the terms on which you offer to sell your product or service to your customer. Terms and conditions are frequently used on eCommerce sites, however, they’re used in all sorts of businesses. If you’re running a service-based business, a more comprehensive Client Engagement Agreement is recommended, especially if there’s going to be an ongoing relationship. If you’re in a heavily regulated industry (like law, finance or construction), find a professional to help you make sure your terms are fully compliant. You also need to make sure they’re all above board in terms of the Australian Consumer Law (more on this later).

The most important things your Terms of Use do are let your visitors know what they can do (and more importantly, what they can’t do) with your website and your intellectual property contained within it. Good Terms of Use can help you to establish trust with your customers, by showing that you are operating within the law. And we all know that in online business, trust is number one. They can also cover your butt if something goes awry (think: defaming comments on blog posts *gulp*)

The key to content marketing these days is to give as much helpful information to your audience as possible. In doing that, you might find yourself creeping over into the realm of giving advice, and I’m not just talking about the lawyers and accountants out there – providing recipes on a kitchenware website, how-tos on a social media marketing page, and so on – that’s all advice in one form or another. Even if your website seems harmless enough, giving advice online can pose a massive risk. A disclaimer is essential to protect you, just in case something thinks it’s a good idea to rely on your all-natural, plant-based, soy diet as a cure for cancer (extreme example, I know, but have you ever heard of Belle Gibson?)

This is the policy you have in place to protect the personal information you collect from your website viewers and clients, such as names, email and physical addresses and phone numbers. A Privacy Policy instils confidence in your users (therefore making them more likely to trust you and even to buy from you) and is required by law for some businesses (generally speaking, if you’re turning over more than $3M a year, you’re included). The presence of a Privacy Policy document on your website also impacts your Google ranking. Keep in mind that mandatory data breach notifications are now in force – huge fines apply if you fail to notify the right people at the right time in the event of a breach. Either your privacy policy or the internal cyber policy (ideally both) should address this, to make sure you’re ready in the event of a data breach.

Get familiar with Australian Consumer Law

If you’re selling within Australia, you need to be all over the Australian Consumer Law like a rash. It’s a law in each state and territory that gives all Australians rights with respect to goods and services they purchase in Australia. If you don’t know your responsibilities under the ACL, you’re far more likely to fail to meet them, and hefty penalties (we’re talking in the millions!) can apply if you do.

“But I’m B2B!” I hear you say. I hate to burst your bubble, but in many circumstances, you’ll still be covered by the ACL. Seriously, just go and read it. Even if in the end it turns out it has zero application to your business, you’ll at least be a super informed consumer.

Get cyber secure

Unless you’ve been living and working under a rock for the last twenty years, the internet is a part of your business in some way. While the internet has been a game-changer for business in many great ways (hello, targeted Facebook advertising), it’s also brought an entirely new layer of risk into our businesses. If there’s one thing you do today, write yourself up a cybersecurity policy.

There are plenty of free resources online to get you started (just make sure you’re looking at reputable sources) and you can always find a professional to help you tweak it and get it just right. Find out what the best practices in your industry are: password protection, need-to-know access to secure information, reputable anti-virus software and so on.

Once you’ve got a policy to protect you, it’s all about setting up the systems and processes to make sure you do what it says you’ll do. Regularly review and update your policy to make sure you’re staying abreast of the latest risks.

Get the right insurance

This is a case of money you can’t afford not to spend. Think about the risks in your business that you can’t reasonably protect, then seek out appropriate insurance to protect against those, such as loss or damage to business equipment and tools, loss of income due to illness or injury and public liability. There are plenty of options available online, including exclusive deals for small business. Just make sure you read the policy and check it’s right for you.

If you’re running an online business, you can’t go past cyber insurance these days. With ransomware attacks on the rise, cyber insurance is a worthy investment, with policies offering access to a team of cyber nerds who’ll help try to recover documents in the event of a ransomware attack and even pay a ransom in the event it’s necessary.

Most businesses don’t have the right insurance. Make sure you do. Talk to a broker if you need more than what a DIY online site can offer.

So – what are the Essentials when Starting a New Business?

- Learn the lingo. If you’re a business novice, find a mentor who can teach you about the world of business and get you up to speed on the key people, things, and dates you need to know about.

- Sort out your IP. Make sure you’re clear from an infringement point of view, then investigate how you can protect and monetize your IP. Talk to an IP professional to work out a plan and budget for it.

- Figure out your business structure. In most cases, it’ll be an evolution over time. Again, make a plan! Find a trusted team of advisors (think: lawyer, accountant, tax planner) to help you put your plan in action.

- Make sure you’ve got all your registrations in place. Again, your team will help you with this task.

- Get your documents straight. Ensure you’ve got the key documents in place to get your business off the ground.

- Know your rights and responsibilities. Study the ACL.

- Think about cybersecurity. A lot. Come up with a cybersecurity policy and follow it. Distribute it to your team.

- Get insured!