Starting and growing a business is hard work. Congratulations on your progress so far – you’ve done an amazing job! If you’re reading this Guide, you’re probably interested in how you can take the next step in your business and register your very own Company.

Good news! We’re going to explain everything you need to know.

This is an important milestone in your business journey. It’s exciting and terrifying, all at the same time. Don’t worry, there’s lots of good stuff to come…

Want to know why you should consider a Company business structure?

- Pay Less Tax

- Protect your personal assets

- Limit your liability

- Introduce Shareholders or Investors

Everything you need to know to take your business to the next level…

With this Guide, we aim to put the power back in your hands by arming you with the essential knowledge of:

- The benefits of having your own Company

- The costs of registering a Company (upfront and ongoing)

- The Steps and Processes involved in changing to a Company structure

- The right time to transition to a Company

- What you need to do next

The benefits of having your own Company

CAPPED TAX BRACKET

You’ve probably heard this one before “You’ll pay less tax!”. So, is that the case?

It COULD be.

Moving from a sole trader to a company could lower your tax liability by giving you access to lower company tax rates. But this will only benefit you if you’re currently being taxed above that company rate as an individual.

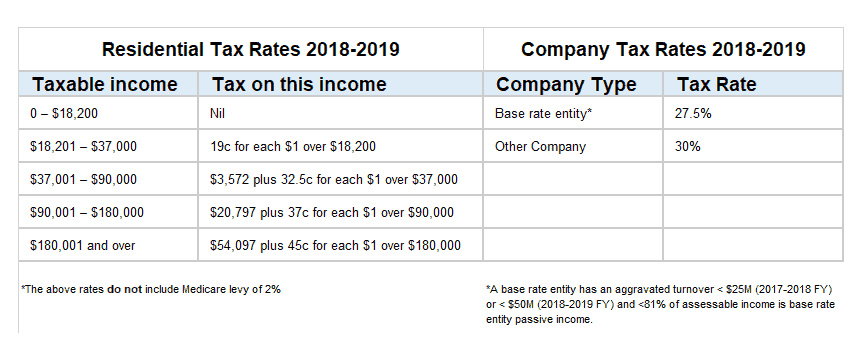

As a sole trader, you’re taxed as an individual at marginal rates on a sliding scale. The income you receive from your business is lumped together with any and all other income you receive, and your total annual income is then taxed. The current individual tax rates go as high as 45% (plus the additional Medicare levy!).

A company on the other hand, is recognised as a separate legal entity and qualifies for a flat company rate of tax (currently at 27.5% for companies with an annual turnover of less than $50 million and 30% for companies with an annual turnover of >$50 million).

Speak to your accountant. They’ll be able to tell you the magic number i.e. how much your individual income needs to be before it makes sense from a tax perspective to move from a sole trader to a company.

You may be there already. In fact, having viewed this Guide, we suspect you are!

TAKING ON PARTNERS AND INCOME DISTRIBUTION

Not surprisingly, a ‘sole’ trader structure doesn’t exactly lend itself to taking on partners and/or splitting business profits.

If you’re wanting to bring in a partner and split profits, the company structure is ideal. In a company, profits can be split any way the shareholders like. For example, each shareholder could receive an agreed base salary and the remaining profit at the end of the financial year could be split in line with each shareholder’s equity level.

A Note on Significant Others

You’d be forgiven for thinking that this benefit doesn’t apply to you if you’re running a solo enterprise.

We have good news for you – you can potentially save on tax by adding your significant other as a shareholder in your company. If a husband and wife, or de facto partners, are shareholders in a company, the company can distribute assets to both the husband and wife, often as the company sees fit.

This can be particularly helpful if one partner earns quite a high taxable income, and the other quite low. By splitting the company’s profits amongst the shareholders, your family can save on tax overall.

LIMITED LIABILITY AND ASSET PROTECTION

An important advantage of the company structure is its limited liability. This means that the personal assets of the shareholders and directors are generally* protected from creditors of the company.

A sole trader however, doesn’t have limited liability. The business owner is personally responsible for the debts of the business, meaning that both business and personal assets (including the family home for example) are at risk. The only asset protection a sole trader has is insurance!

BRINGING IN INVESTORS

Capital raising could be a good reason to move to a company structure. It’s usually easier to attract new investors if your business is structured as a company (due to its limited liability and the ease of transferring shares). Most investors won’t invest in sole traders. Full stop.

SUCCESSION PLANNING

As unbelievable as it may sound right now, you will leave your business at some stage. Whether that’s by death, retirement, sale or simply deciding to move on to something else.

If you want your business to be able to continue without you one day, it’s important to think ahead. A sole trader business can’t continue without you, baby! A company, being a separate legal person, can.

This means you can pass your business on to your family or team, or even sell it and cash in!

Things to consider in succession planning include not only how you may exit the business, but also how you will retain key personnel and develop skill retention strategies, to ensure a smooth transition when you do move on. Preparing a Succession Plan is a great way to address these issues.

The costs of registering a Company (upfront and ongoing)

SETUP COSTS FOR LAWYER AND ACCOUNTANT

While you can DIY your company registration, we recommend getting a professional lawyer and accountant involved to ensure you get this crucial step right.

It’s more than simply form filling, there are numerous legal documents to be prepared (from member and director consents to shareholders’ agreements) and important decisions to be made where the wrong one could cost you thousands to fix up down the track.

Your accountant handles the numbers side of things, making sure the transition of your cash and accounts into your new structure goes smoothly and you don’t have to pay any unnecessary fees or taxes.

At Her Lawyer, we charge fixed fees for company registration as well as the preparation of shareholders’ agreements and constitutions. No nasty surprises from us!

ASIC COMPANY REGISTRATION FEE

You’ll also need to factor in government registration fees.

ASIC’s current application fee for registering an Australian company is $506.

ANNUAL ACCOUNTANCY FEES

Unless you have an accountant in-house, you’ll need to engage an accountant to prepare your company’s annual tax returns. This is in addition to your personal tax return as well as quarterly BAS filing.

Ask your accountant for a ball park quote to prepare a company tax return so you have an idea of what the company’s expense will be here.

Note that if your company structure is complex (think holding and trading companies and/or trusts!) your annual accountancy fees will be higher than a simple single company structure.

PAYING YOURSELF AS AN EMPLOYER OR DIRECTOR

Ideally the company will be paying you a regular salary (including or excluding compulsory superannuation contributions) with the pay as you go (PAYG) tax being taken out and remitted to the Australian Tax Office.

An accountant will be key here too, helping you figure out the best way to pay yourself.

CAPITAL GAINS TAX IF YOU SELL THE BUSINESS OR ASSETS

There may be Capital Gains Tax implications in transferring your business or assets from your sole trader entity to the company entity. See the section below on Small Business Restructure Rollover and check with your accountant.

The Steps and Processes involved in changing to a Company structure

SHAREHOLDERS’ AGREEMENT AND CONSTITUTION

If there will be more than one shareholder you’ll want a Shareholders’ Agreement prepared prior to the company’s registration to:

- ensure that share allocation and pricing are agreed (which may not be as simple as you might think, especially when shareholders opt for shares to vest over time);

- govern the shareholders’ relationship and business arrangements; and

- protect each shareholder’s interest.

The shareholders may also decide to adopt a constitution to govern the company’s internal administration and management, rather than to rely on all or some of the replaceable rules contained in the Corporations Act 2001.

In this case, you’ll want a lawyer to prepare this important document.

APPLICATION TO REGISTER

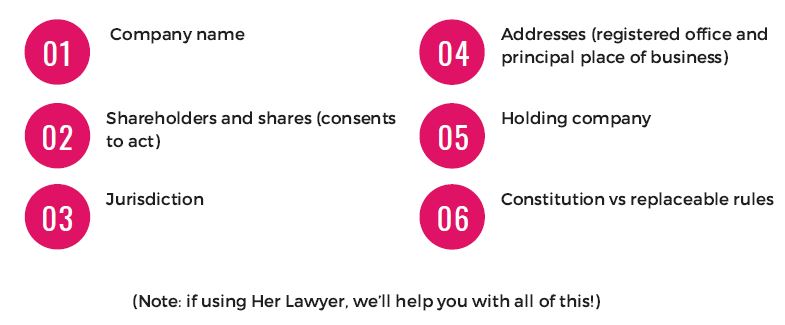

In order to register your company, you’ll need to decide or obtain all of the following details which will form part

of your application:

COMPANY RECORDS

Once registered you’ll need a formal Register of Members prepared.

The Register, along with the initial member, director, secretary and premises consents, should be stored securely with the minutes of company meetings and other records and be available to provide to ASIC on request.

OTHER REGISTRATIONS

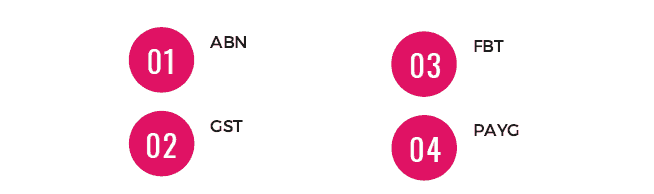

You’ll also need to determine if you need to register for the following additional registrations:

TRANSFERRING ASSETS

The business assets owned by the sole trader entity are not owned by the new company unless they are legally transferred.

Transferring assets can incur transfer costs and the tax implications (Capital Gains Tax, gulp!) make this a complex step in the change-over process.

It’s essential that you work closely with your legal and accounting teams to make sure you transfer all your assets correctly and avoid litigation and costly rectification later.

DIRECTOR’S DUTIES

By giving your consent to act as a director of your company you’re agreeing to comply with the obligations imposed on directors by the Corporations Act 2001.

You’ll need to familiarise yourself with these directors’ duties. Some of the important duties include:

- To act in good faith

- To act in the best interests of the company

- To avoid conflicts between the interests of the company and the director’s interests

- To act honestly

- To exercise care and diligence

- To prevent the company trading while it is unable to pay its debts

- If the company is being wound up – to report to the liquidator on the affairs of the company

- If the company is being wound up – to help the liquidator (by, for example, giving to the liquidator any records of the company that the director has).

There are civil as well as criminal penalties for directors who fail to perform their duties. For more information on your duties as a director, click here.

SMALL BUSINESS RESTRUCTURE ROLLOVER

The small business restructure rollover (Rollover) is designed to allow small businesses to change their legal structure without incurring the tax costs that would normally apply when a business is transferred.

Get advice from your accountant on whether your business is eligible for the benefits of the Rollover.

The right time to transition to a Company

BUSINESS INCOME AND INCOME FROM OTHER SOURCES

When the income from your business starts pushing your personal income into those high individual tax rate

brackets (hello 45%!), it’s time to seriously consider restructuring.

Likewise, if you have income from other sources which, when combined with your business income, push you

into those high individual tax brackets, the time may have come.

Your accountant or tax expert is the best person to advise you here.

MORE THAN ONE BUSINESS

If you run more than one business as a sole trader, you may benefit from separating them legally by restructuring.

It’s smart to separate the risks and profits in each business. This is also recommended if you’re thinking of selling one or more of your businesses, or if you’re looking for partners or investors in one but not the others.

Whether you restructure just one or all of your businesses, if you have more than one business on the go, restructuring could benefit you.

PERSONAL ASSETS

As a sole trader, your personal assets are on the line.

If you’re at a stage where those assets are worth a lot (and don’t think that because you co-own your house with your hubby it’s off the table, it isn’t!), now would be a good time to move to a company where your liability is limited (and personal assets are off the table).

SIGNING UP FOR LIABILITIES

Similarly, if you’re a sole trader planning to take on liabilities such as entering into a commercial lease or employing someone, now would be a good time to consider the restructure.

Moving to a company structure will mean that if you’re unable to pay your debts for whatever reason, your personal assets are protected.

YOUR BUSINESS PLAN

If you’ve set big hairy audacious growth goals for your business and you’re making progress towards them (Hell Yes!), you’re likely going to outgrow the sole trader structure.

So now would be a good time to look at making the change.

NEW FINANCIAL YEAR

A new financial year is an ideal time to begin trading out of a new entity. This will allow you (in theory at least) to close the books of your sole trader business on June 30 and open the books of your new company on 1 July.

If you’re aiming to start trading out of your company in the next financial year, ensure it is registered before 30 June. This way you’ll have the paperwork you need to take to the bank to open your company’s bank accounts.

Allow at least 2 – 4 weeks to make sure the registration process is completed in time.

What you need to do next

- MAKE AN APPOINTMENT WITH HER LAWYER

Book in a free chat with a member of our friendly team now, to talk about how we can help and the next steps. - MEET WITH YOUR ACCOUNTANT

Don’t have an accountant of your own yet? Not to worry – we can recommend a fantastic accountant (Australia-wide) to help you . - MAKE A BUDGET, TO DO LIST AND TIMELINE

After your appointments with Her Lawyer and your accountant, you’ll be in a position to put a budget together for this change-over project, as well as a to do list and timeline. Don’t miss our free PDF version of this guide to access the To Do list.

After your appointments with Her Lawyer and your accountant, you’ll be in a position to put a budget together for this change-over project, as well as a to do list and timeline. Don’t miss our free PDF version of this guide to access the To Do list.

Teething Period

Expect a teething period during the change-over. You’ll have two entities with different bank accounts and it’s important to keep the business activities of the two entities separate for accounting and tax purposes.

If your clients accidentally deposit money into the wrong account, the money will need to be moved to the correct account and relevant entries made in both sets of books.

The same goes for supplier bills – make sure they are paid out of the correct entity. If you’re organised, the teething period should be short and relatively painless.

Next Steps

Transferring from a sole trader to a company is a savvy move for any business owner who’s outgrowing (or already outgrown) their existing structure.

Don’t leave it until the last minute. Contact Her Lawyer today to get the ball rolling.

If you’d like to keep this guide handy, you’re in for a treat…because we’ve got an excellent content upgrade for this post.

We’ve put together a PDF with all the information in this guide (and more!). It also includes a free To Do List which you can print out.